Fix and Flip & DSCR

Loans Now Available.

To get started, complete the form and we will get you a quote right away.

We provide a path with great options to fund real estate investment deals.

All applications are subject to review and approval; submission does not guarantee acceptance.

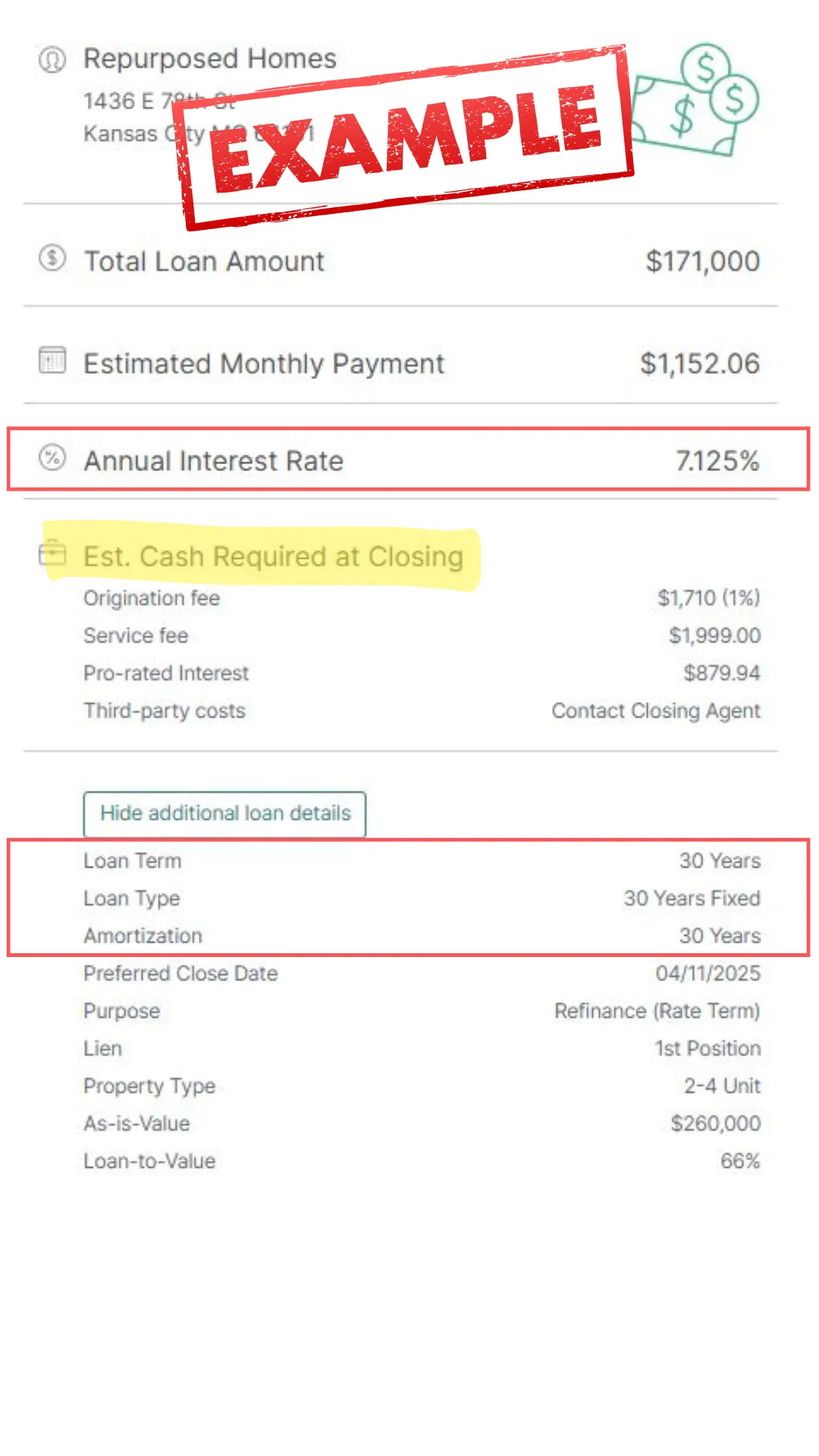

This was a DSCR Loan example that we did recently for a duplex where a seller held back a note originally. Results may vary based on deal, property value, ratios, and market rates.

Fix-and-Flip / Bridge Loans

Up to 90% LTC* and 75% ARV

*Rates as low as 7.75% to 12%

*Loans from $100K-3M*;

Up to $8M* in total loans per borrower

12, 18 and 24-month terms available

Up to 100% of rehab financed with interest as drawn/disbursed all

†loansNo application fee;

No income or employment verification

Quick closings - as fast as 7 business days to compete with cash buyers

Single Asset DSCR Rental Loans

Rates as low as 6.625%

Loan up to $500k after a property is owned for 90 days

Loan up to $500k after a property that is free and clear

3, 5, or 7-year options, including

3-year step-down pre-payment penalty options

Up to 80% LTV

*Single-family homes, attached/detached PUDs, 2-4 units, and condos5/1 ARM, 7/1 ARM, 30-year fixed, and interest-only options available

Make sure you join our Facebook Group to see more way to positioning offers, deal structure and creative financing to do more deals.

The above is provided as a convenience and for informational purposes only; it does not constitute an endorsement or an approval by the lender of any products, services, or opinions of any corporation, organization, or individual. The information provided does not, and is not intended to, constitute legal, tax, or investment advice. The lender bears no responsibility for the accuracy, legality, or content of any external sources.

*Rates are based on loan terms, borrower qualifications, LTV, and property factors and are subject to change. Loans are available for non-owner-occupied rental properties only. Interest rates or charges mentioned herein are not recommended, approved, set, or established by the State of Kansas. Loans are available in AL, AK, AZ, AR, CA, CO, CT, DE, FL, GA, HI, IA, ID, IL, IN, KS, KY, LA, MA, MD, ME, MI, MN, MO, MT, NC, NE, ND, NH, NJ, NV, NY, OH, OK, OR, PA, SC, SD, TN, TX, VA, WA, WI, WV, and WY, as well as Washington D.C.

**Loans in which the borrower uses secondary financing sources do not qualify for interest as drawn. If secondary financing is obtained, borrowers will be unable to receive construction draws until resolved.

*Total project costs are defined as the sum of land/structure, soft costs (e.g., permitting, general contractor fees), and hard costs (e.g., vertical construction costs).

+To receive the first draw, borrowers must have secured permits. Permits are not required for closing.

**In California, loans are eligible for a maximum loan size of $3M and a maximum rehab budget of $2M. In all other states, the maximum loan size is $2M with a maximum rehab budget of $1.5M. Rates are based on loan terms, borrower qualifications, LTV, and property factors and are subject to change. Loans are available for non-owner-occupied properties only. Interest rates or charges mentioned herein are not recommended, approved, set, or established by the State of Kansas. Loans are available in AL, AK, AZ, AR, CA, CO, CT, DE, FL, GA, HI, IA, ID, IL, IN, KS, KY, LA, MA, MD, ME, MI, MN, MO, MT, NC, NE, ND, NH, NJ, NV, NY, OH, OK, OR, PA, SC, SD, TN, TX, VA, WA, WI, WV, and WY, as well as Washington D.C.

New construction loans in which the borrower uses secondary financing sources do not qualify for interest as drawn. If secondary financing is obtained, borrowers will be unable to receive construction draws until resolved.

Exceptions may apply.